I’m genuinely dazzled by Betfair.

Nobody regulates its prices and yet the markets are astonishingly, almost mysteriously efficient.

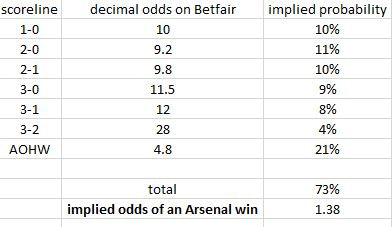

Take, for instance, the Correct Score market on a match such as Arsenal v Stoke this weekend.

If we list the Betfair odds on the various potential scorelines that could deliver an Arsenal win, then convert them to probabilities and add them up to reach a total percentage figure…

…And then convert that probability back to a decimal odd for comparison with the price offered on any old Arsenal win in the Match Odds market….. we find that, mysteriously, the two numbers are the same!…

Yet nobody, anywhere, forces them to match.

Just in case my explanation isn’t clear(!), here follow the odds for all possible scorelines in the event that Arsenal win, converted to a percentage probability, then re-converted back to a single decimal odd for any Arsenal victory….

…and we can see that the decimal chance that Arsene Wenger finishes the day contented is 1 divided by 73%, which equals 1.38….

And mysteriously, the odds for an Arsenal home win in the Match Odds market are, you-guessed-it-folks, 1.38…

This is how an efficient market works.

This sort of consistency exists all over Betfair and is the result of a mysterious, silent price negotiation between those folks who choose to sell the chances of an Arsenal win and those who decide to buy that same risk.

The great Adam Smith famously referred to the method by which this equilibrium is reached as the ‘invisible hand‘ of the market.

Bookies employ people to set prices; but Betfair employs nobody and does it much more accurately.

It’s an everyday miracle… and one with implications for each and every punter.

Liquid Betfair markets give us a benchmark for value that we should not ignore….

… and Premier League markets are ultra-liquid.

Here’s the rub: If you can get a price for any outcome of a major sporting event that is better than that offered by Betfair, it follows that you almost certainly have a value bet.

So instead of having to ask yourself ‘is this a value price?’, you will know.

Wow.

All you then have to do is find enough value bets by this method, place your bets…. and you should, if mathematics has anything to say on the matter, ultimately end up in the black.

That may all sound somewhat unlikely so let’s take an example.

Now, one refinement that I like to adopt is to search Oddschecker for complete books that violate the bookies’ usual principle of aiming for an “overround”.

Put more simply, we need to find total probabilities for a major event that add up to less than 100% – then work out why they do.

Usually, in the case of the Match Odds market, we find that one of the possible outcomes is priced longer than on the exchange.

This is a value bet.

One such is indeed the Arsenal v Stoke game we have been looking at.

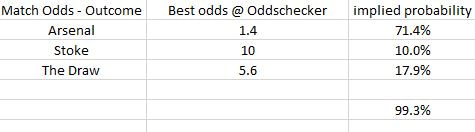

If we look at the Match Odds for this game on Oddschecker, we can see that the odds for an Arsenal win are in fact longer, at two bookies, than they are at Betfair:

Both Betstars and Stan James are offering a price of 1.4 on an Arsenal win, two ticks higher than the super-efficient Betfair market.

If we add up the probabilities for all three outcomes, as represented by the best prices we can find, we can see that the total percentage probability is below 100%! –

Now, as the odds for a Stoke win and the draw are no better at the bookies than they are at Betfair, it follows that a bet on an Arsenal win here represents the value option.

And betting on Arsenal to win at home makes you look precisely like the kind of mug punter that bookmakers will welcome with open arms….

It’s a truly lovely punt.

Now here’s hoping Sanchez and co. deliver!

Summary

This sort of thing is much more common than you might expect, particularly in the Premier League markets, as they are so hyper-competitive.

Bookmakers are desperate to win a larger slice of the huge sums ventured on the most high profile matches and so will periodically offer generous prices – when really they shouldn’t.

To repeat, the strategy involves:

- finding a Best Book at Oddschecker the probability of which comes to under 100%

- comparing the odds with Betfair to find which of them is the outlier…. usually, just one will be.

You don’t have to know anything about football or pricing risk.

The invisible hand at Betfair tells you everything you need to know.

Do let me know how you get on with it.

Lucy

The following page from the link does not seem to be working, can you send me the calculator

Please?

Hey Pete

This post is way before my time. I’m afraid I don’t have access to the calculator that Lucy mentioned.

Thanks will read this

G

Great article though. It reminds me of a trader friend I know . He is given horses with the prices extended . Many people wrongly believe these horses are seen as weakness by the bookie and may lay them.

But the truth is the bookie only wants his slice of the volume , that’s been thrown at these horses and is balancing his book .

G

George

Thanks for the kind comments. I’m sure bookies play all sorts of games in early markets so they don’t get burnt once the volume comes in.

I don’t believe Betfair employ odds compilers, though I’m happy to be corrected.

Lucy

Hi Lucy pretty sure Betfair employ compilers who set the initial market, then let the wisdom of crowds take over .

G

If I’m wrong slap me!