As soon as you introduce the subject of trading, a lot of punters get worried.

It just sounds so complicated.

Isn’t trading really just a strategy for high rollers, or perhaps sophisticated City types who can understand and predict the vagaries of the market?

Well, of course, it helps if you have access to a huge bankroll, and vast cloud computing resources running expert systems.

But really it needn’t be that difficult. And I intend to prove it in this article.

Before I begin however, I must stress the obvious.

There are no certainties in the marketplace, and what I’m going to propose is NOT risk-free.

So if you’re not comfortable with at least a degree of risk, please read no further.

However, what I’d like to propose is

- low-risk

- likely to make you money in the long run; and

- carries no transaction costs.

Better still, it contains a degree of insurance in the event things go wrong.

Interested?

Good. 🙂

This trading strategy exploits three features of the UK’s daily horse racing markets.

- Betdaq’s remarkable 0% commission offering on the first UK horse race of the day in 2013

- The Best Odds Guaranteed (BOG) promise made by many major bookmakers. (And if you don’t know what BOG is, please see my FAQ page)

- The very small (often non-existent) gap in prices between the bookies and the exchanges at the short end of the market.

Essentially, all we are aiming to do is trade short-priced steamers in the UK’s first race each day.

To do so, we back a promising horse at a BOG bookie, and lay it off at Betdaq, for a risk-free punt on one of the favourites.

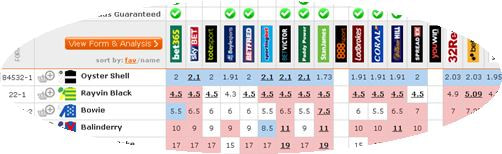

Take today’s opening race as an example. It was the 1.25 at Market Rasen, and, half an hour before the off, the prices at Oddschecker.com looked like this.

Our interest is limited to the two or three shortest-priced horses. If any of them can be backed at a BOG bookmaker at at least the same price for which it can be layed at Betdaq, it is a possible selection.

This happens a lot more often than you might expect. Very often, bookie prices at the short end of the book represent excellent value. The much-vaunted pricing benefits of the exchanges are much more noticeable on longshots.

So… In today’s race, Oyster Shell could both be backed at Paddy Power, and layed at Betdaq, at 2.1, so it passed our test.

You can tell whether a bookie offers BOG pricing from the presence of a green tick immediately above its name on the Oddschecker screen.

The second step is to check the price/volume graph for our selection.

Now this is a more of a judgement call, but essentially I’m looking for a steep decline in the horse’s price in the run-up to the race.

Once again, Oyster Shell passed this test. If we look at the Betfair graph (sorry,old habits die hard!) for our horse, you can see that the price trend has been steadily down for some time. This is a very strong trend.

Now I don’t propose to write a thesis about trend following, but instead would encourage you to ‘go with your gut’. If you’re not convinced that your selection is trending downwards, don’t trade!

If however, you’d like more information on trend following, the following video is a good introduction. It talks about stock trading, but the principles are just the same.

OK, so we have decided that Oyster Shell is trending downwards. All we do now is back him at our BOG bookie, and lay him for precisely the same stake at Betdaq.

We don’t have to worry about over-laying to cover commission, as none applies.

But… what price should we lay him at?

I select odds of 90% of the back price. Which is calculated as follows:

LAY PRICE = ( ( (Current back price MINUS 1) * 90% ) PLUS 1).

Thus, in the case of Oyster Shell, the target lay price = 1.99 = (((2.1 -1) * 90%) + 1).

I have put together a simple spreadsheet here to work out the lay price for you.

Finally, I set the “Keep In-Running” option on my lay bet, to ensure that my lay bet will not be cancelled by Betdaq if it hasn’t been matched before the off. In most cases, my lay bets get matched before the race, but if not, they will now almost certainly be matched in-running.

It is of course possible that your lay bet may not be matched in-play, in which case you may lose the entire value of your back bet. However this is very unlikely. Favourites trade freely in-play, and a 10% reduction in price will usually be quickly lost in the ‘noise’ of in-play punting.

However, if the possibility of a total loss bothers you too much, you are trading outside your comfort zone and must reduce your stakes.

And that’s it! A simple strategy for trading favourites on one UK race each day.

And the insurance I mentioned?

Well if we are unlucky with our trend, with the favourite suddenly beginning to drift not steam, our BOG bookie is likely to allow his price to drift too, thereby covering our increased exposure.

You even get days where the back price drifts; the lay bet matches in-play; and your horse wins and pays out far more than originally expected, owing to the widened gap between the two sides of the trade!

So how did it go today?

Oyster Shell traded in-play well below 1.99 (and was matched as low as 1.26 on Betfair), so my lay bet got matched for the same stake as my back bet.

Unfortunately, he could only finish third, which produced a neutral outcome. i.e. I won the same amount at Betdaq as I lost at my bookmaker.

Lucy x

Richard,

No they’re not.

Betdaq are offering 0% Commission on all the 12:45pm PL games throughout the 2014/15 season, but of course there’s no football equivalent to the bookie’s BOG offer.

I did subsequently develop the trend-following idea in my successful Trading Steamers thread.

Lucy

Hi Lucy,

Just come across this thread, while looking for something else!

Are Betdaq still doing this offer, do you know? I’ve looked at their promo page and it isn’t mentioned, though i see the footy offer is running for the 2014/15 season.

Also, did you look into an easy way of taking advantage of the offer?

many thanks

Richard

Some excellent info for trading Betdaq.

Is there a possibility of having your Betdaq account closed if only using them purely for the 0% comm. offers?

I realise that it is still punter to punter betting, but will Betdaq gain anything from these offers?

When Ladbrokes closed my account, they stated that they only wanted losing accounts, or have I got it wrong?

Johnny

I can’t see any reason why Betdaq would close anyone’s account, as it’s not as if you’re winning money from them. Plus they do genuinely benefit from “0% commission only” customers, as we add liquidity for everyone else.

Of course, if everyone just used the 0% markets, I’m sure Betdaq would review their strategy. But they won’t. Instead, a certain percentage will start to leak across to other markets as they get used to the Betdaq interface.

Many businesses will give product away to get you to shop at their place at least once. The idea being that, psychologically, new clients reframe themselves as “people who shop here” once they’ve crossed the threshold for the first time.

In essence, Betdaq’s 0% offers are a testament to the power of inertia. They clearly believe a lot of folks use Betfair out of little more than habit, and are prepared to take what is a fairly radical measure to make us all sit up and think.

Lx

Lucy,

Thanks

Further to this thread, Betdaq have now added another 0% commission offer –

http://www.betdaq.com/UI/?pc=CommFreeFooty

Basically, they’re offering 0% commission on every 12.45pm Premier League game on a Saturday, on all markets throughout the 2013-14 season.

I have yet to work out the best way to exploit this one, but it does look a candidate for further simple arbs. 🙂

Lx

@ andy

thanks for taking the trouble to explain your method. youve explained it just as i expected now its much clearer.

@Andy hi is it possible you could go through what you do using an example with figures as I’m a bit slow and dim …

Regards

Chris

Hi Chris, no worries.

So say we have the first race of the day, and it has 10 horses. The front three are priced at 2.1, 3.5 and 6 on Betdaq. So now we find some Best Odds Guaranteed bookies using Oddschecker that have prices close to the same as Betdaq. If you keep checking back, sooner or later the back odds with the bookies, and lay odds with the exchange will match a few times before the race.

So we find the favourite is at odds of 2.1 with Bet Victor, so we’d back it with £50 there, and straight away lay with with £50 at the same or lower odds on the exchange. Once both bets are locked in, there’s no risk to either of these sums.

Now about half an hour later, the odds on the next runner have touched 3.5 on Betdaq, and William Hill are still offering 3.5. So we back with again with our chosen stake, and lay it at the same odds with the same stake.

Repeat the process again for the 3rd runner. You could do this with as many horses as you wish so there’s no set rule about only using one horse.

Now when we get to about a minute before the race, have a look at what odds the three bookies you’ve used are now offering. If the odds have drifted on any of them, now we are in with a good shot of easy money. So you would now find a matched betting calculator, or back/lay calculator, either of which can be found with a quick google search. Enter the new back odds that you know the bookmaker will pay out on, and the lay odds you took earlier, and this will calculate the new lay stake. So we have created an arb. Subtract your initial stake from the newly calculated stake and you will have a smaller number. Now enter another lay stake equal to this new number we’ve generated, at the same lay odds you took earlier, and select the option allowing the bet to go in play. If it is matched in play we make money, if not, we lose nothing.

I realise that was a huge explanation so I’ll give a proper example.

We’ve backed a horse with £25 at 3.5 at Bet Victor, and layed it with £25 at 3.5 on Betdaq earlier in the day.

Now just before the race, Bet Victor’s odds have drifted on the same horse to 5.

So we find a calculator, enter the stake of £25, the new back odds of 5, and the same lay odds of 3.5.

The calculator will show you could lay £35.71 at odds of 3.5 to guarantee a profit of £10.71.

However we have only layed it earlier with £25, so we need to put in a new lay bet of £10.71 at 3.5 to make up the difference, and allow it to go in play to be matched during the race.

If that extra lay isn’t taken, we haven’t lost anything, but if it is then we’ve made a free £10.71. If you can make that every day you’ll be sitting on £300 a month.

That was a lot in one go so if you’ve any questions, Lucy wont let me go without answering them 🙂

I’ve not been particularly meticulous recording the Betdaq trades, regarding it as beer money. Which I might add is now completely gone owing to a series of extravagant nights out, Peter’s course and same day flights from Glasgow! I know it is very profitable though and when I top up the Laddaq balance I’ll make sure I record them and send it over to have a look at if you want.

You get some crackers when there’s a ‘friendless’ horse, the bookies are forced to push a price right out to take any bets and you win up backing at 5, laying at 2!

As a quick footnote don’t use Ladbrokes to do this with, since they now own the exchange and have easy access to your trading activity.

I actually still use the bonus bagging calculator to work this out, maybe I’m just nostalgic of the early ‘free money’ days!

I will be absorbing absolutely everything so I’m happy to share not just my experience with the course but my progress a month or two down the line from it. My gut feeling is that it is dramatically underpriced but we shall see on the 24th.

Nathan, I love the Light Trading concept, but I’m that risk averse I can’t tolerate the idea of losing a stake. I can’t even use strategy K, despite it being the definition of value! Silly me!

Andy

@ Andy – I agree with Nathan: your version sounds more promising than mine! It would be interesting to see what percentage of drifters you get?

@ Nathan – You’re very kind, but I think we both know where the Light Trading technique in my £1k manual came from!

@ Andy and Mike – Yes I would be very interested in a review of Peter’s course. It would be instructive to see if you feel as positively as Maria in June 2012.

Lx

Andy I’d be very interested in any comments on Peter Webb’s course

as I’m thinking of attending it myself.

Mike

Lucy,

There is no need for you to defer to me on ANYTHING!

Many of the trading methods I use came to fruition thanks to you and your strategies.

Andy,

That is another great idea, and it’s totally risk free!

The chances are that at least one of the top three in the market will drift prior to the off, then trade in-play knowing what the potential returns will be with the bookmakers.

Trading really can’t get any easier than that!!

@James everybody has a different tolerance to risk, but ultimately if you are trading and you manage to lose a full stake then you have crossed the line into outright gambling and need to rein that instinct in. I do agree that not everybody can do it, although perhaps for different reasons.

I do something a little bit different with this type of trading (also using the commission free race). If you can back/lay the front three runners at the same price over the morning using BOG firms (ie no loss), simply wait and see if any of them drift and recalculate the lay stake (overlaying to guarantee a profit) using the new back odds just before the off. Add the rest of the lay stake to be taken in play at the original odds you took and if it is taken, you’ve created a tasty arb! This way there is no risk of losing a full stake, only the profit margin.

Finally, @Lucy I’m attending Peter Webb’s trading course at the end of the month so if you’d like a review just holla!

Gentlemen,

Interesting comments.

@James… I quite understand your viewpoint and certainly, if you feel uncomfortable with any method, my advice would always be – don’t do it.

That said, trend following is an established trading technique across all kinds of markets; and my experience of the method described here is that I almost always get matched before the race anyway.

A further refinement that can be applied is only to trade races over, say, 12 furlongs. This change allows more time for in-play matching; with the general hyperactivity of markets in-running usually causing bets at these levels to be quickly mopped up prior to a clear winner emerging.

@Nathan – I defer to your greater experience of this type of trading! I do however especially like your modification regarding outlying bookie prices.

Lx

James,

Your last comment is particularly interesting, I think.

If it works, then it will work for everyone, surely?

Why would it work for some, but not others?

The method itself won’t be unkind or unfair to you, it will only be your decision making or application of the advice given that could result in this not working for you, to be honest.

The rare losing trades, with a low risk of not getting the lay bet matched, could well be balanced by the decent sized wins, when a drifter ends up winning at better odds with the BOG bookies. This happens more often than you may think!

I would like for trading like this to work, but there is always the risk of losing more than we win. As with most trading, the profits are small, and you can lose your entire stake on a trade. So not a believer of trading, especially when you have to make your own trades. Can it work, sure, but not for everyone.

Excellent advice, Lucy.

My preference would be to target a small profit by laying a little over the amount staked on the back bet, rather than just lay off for a zero outcome.

As you suggest, this isn’t risk free but very close to it.

A good indicator for suitable selections is when only 1 or 2 bookies are offering the best price, so you are getting decent value to begin with.

This has plenty of potential, I think.